what is suta tax rate for california

Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. Click Manage Taxes under the applicable State Tax section.

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

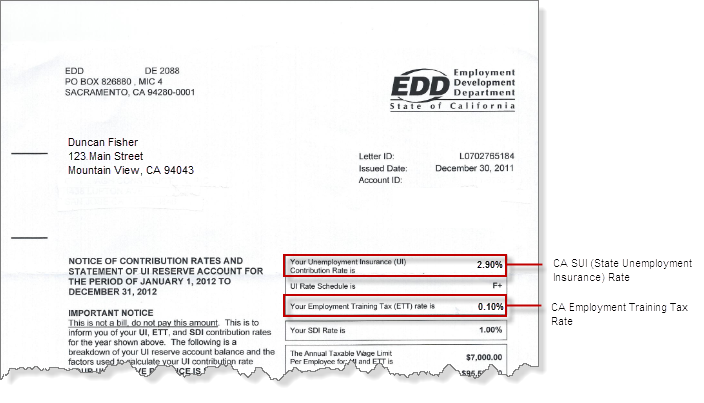

Most states send employers a new SUTA tax rate each year.

. Besides some states assign a generic new. Sales tax applies to the sale of that property if located inside California at the time of sale and use tax applies to the use of property purchased by Corporation A outside California which is first functionally used inside this state or which is brought into California within 90 days after purchase unless the property is stored outside this state on half or more of the time during the. Form 941 is required of all employers except household and agricultural employersPayroll Mate also prepares Form 944 Employers Annual Federal Tax Return.

Through the State Unemployment Tax Act SUTA. A new civil penalty of up to 5000 will apply if a person simply advises another business to participate in SUTA Dumping and is not an employer. The California SDI tax rate is 100 percent of SDI taxable wages per employee per year.

The Federal Unemployment Tax Act FUTA. SUI tax aka SUTA tax and FUTA tax are both unemployment-related payroll taxes. For more information about how your UI rate is determined refer to Information Sheet.

Each state determines the wage base or minimum earnings required for SUTA to be deducted. As you may imagine the SUTA tax rate will depend on the state and rates can range from as low as 0 to as high as 1437. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

The maximum tax is 122909 per employee per year. You may receive an updated SUTA tax rate within one year or a few years. This is a current list of the 2022 payroll tax table updates that have been and will be implemented in Costpoint version 81x.

The national unemployment rate 39 percent fell by 03 percentage point over the month and was 28 points lower than in December 2020. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27. SUTA Tax Rate for 2020.

Y The UI tax rate for new employers is 34 percent 034 for a period of two to three years. If your notice says you have a rate of 055555. California System of Experience Rating DE 231Z PDF.

Now that weve discussed the FUTA tax rate for 2019 and 2020 and how those calculations work lets break down SUTA taxes. Your state will assign you a rate within this range. 2022 2021 Taxable Wage Base per Employee.

Bureau of Labor Statistics News Release State Rates 2009-2017. Others may refer to it as unemployment insurance UI. SUTASUI 7 State Unemployment Insurance 340 9 1 st 7000 10 ETT Employment Training Tax 010 1st 7000 11 11 700 maximum tax.

Hawaii employers may choose to cover the cost of temporary disability insurance for their employees or may hold up to 05 percent of an employees weekly wages up to a. Click the Taxes compliance section and select Tax setup. The Voluntary UI program is not in effect for 2021.

The percentage of State Unemployment Tax or SUTA varies by state. 2022 Payroll Tax Rates Taxable Wage Limits and Maximum Benefit Amounts Unemployment Insurance UI y The 2022 taxable wage limit is 7000 per employee. The UI tax rate would also be increased to the maximum tax rate but not less than a 2 increase for the year in which it was determined that employers engaged in intentional SUTA Dumping and for the next three years.

2019 legislation SB 298Act 512 year changes the way that Arkansas determines the SUI wage base starting with tax years after 2019. Net Tax RateCalifornia Oregon Washington Illinois 06 06 STATE UNEMPLOYMENT TAX ACT SUTA. This tax form shows the total FICA wages paid the total FICA taxes and federal income taxes withheld.

These factors typically include things like the number of employees and the amount of wages paid to employees during the. SUTA Tax Rate and Wage base Limit by State For 2021 State SUI New Employer Tax Rate Tax Rate Range for Experienced Employer State Wage Base Limit. 12 4200 maximum tax but see fn.

The states SUTA wage. How FUTA Affects SUTA. Similarly wage bases also vary by state.

9000 taxable wage base x 27 tax. Your state typically tells you what your SUTA tax rate is when you register as an employer. Click Add a new rate.

For example if the gross taxable income for a particular pay period was 1250 then the Medicare deduction would be 1250 x 145 1813 and the Social Security deduction would be 1250 x 62 7750. The State Disability Insurance SDI. Each state has a standard SUTA tax rate for new employers and it will be different for employers who are in the business for long.

The maximum tax is 122909 per employee per year. The rate is 6 of an employees first 7000 in taxable wagesbut it can be credited by up to 54 depending on how much an employer pays in SUI taxes and whether the state repaid any federal loans related to the. MR Regulatory Update Remarks MR 811.

The HI Medicare is rate is set at 145 and has no earnings cap. The Employment Training Tax ETT rate for 2021 is 01 percent. Scroll to State Tax Settings and click edit next to SUI Rate.

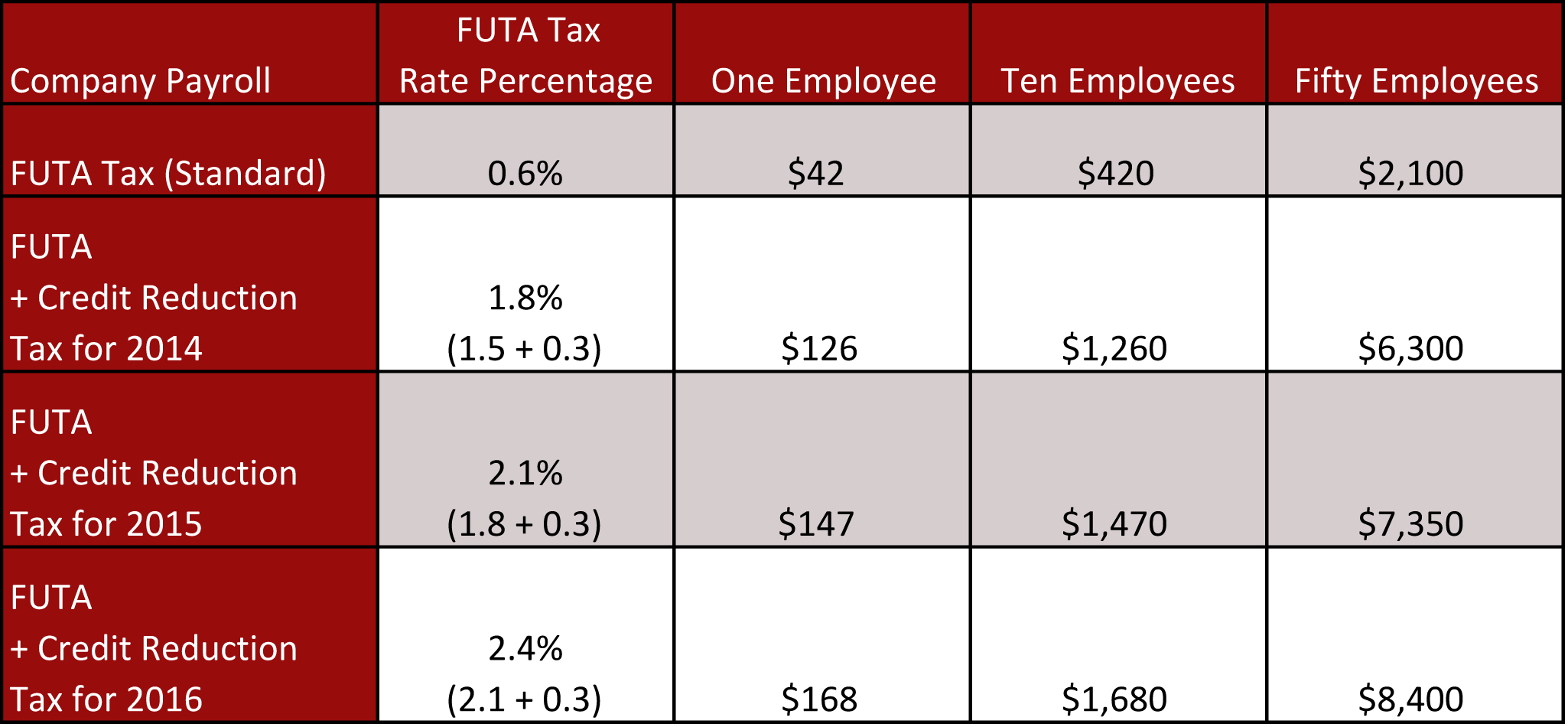

Form 944 can be used in place of Form 941 by employers who owe 1000 or less in employment taxes. Thus the minimum amount an employer can pay in FUTA tax is 42 per employee. The SUI wage base set by law at 10000 for 20182019 will now be determined each year by the average seasonally unadjusted UI benefit rate for the preceding fiscal year July 1 through June 30.

Using the formula below you would be required to pay 1458 into your states unemployment fund. An employer that qualifies for the highest credit will have a net tax rate of 06 calculated as 6 minus 54. Whether or not youre liable to withhold SUTA tax depends on a couple of factors.

Virgin Islands 2021 FUTA Credit Reduction. Once paid these taxes are placed into each states unemployment fund and used by employees who have separated from their place of employment. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

Each state has its own range of rates. The UI and ETT taxable wage limit remains at 7000 per employee per calendar year. Y The UI maximum weekly benefit amount is 450.

Self employed persons must pay an amount equal to the sum of both the employeee and employer portions. Payroll taxes are calculated by multiplying an employees gross taxable wages against the applicable payroll tax rate. FUTA is the tax paid by the employer at the federal level.

The table below shows the wage base limit and the SUTA rate for each state. Enter the number shown on the notice as a percentage rate. SUTA tax requirements by state.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Also the SUTA rates are affected by an employers specific unemployment history and industry. Employers must pay a matching amount for each tax component.

Generally states have a range of unemployment tax rates for established employers. 13 For wages paid on or after 1113 additional Medicare tax at 09 must be withheld from wages in excess of 200000 for a combined withholding rate of 235. Depending on the UI benefit rate the SUI wage.

New York State 2022 Tax Withholding Utah 2022 SUTA Wage Base US. Companies that neglect to pay SUTA or SUI taxes may be subject to fines and. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400.

For example the SUTA tax rates in Texas range from 031 631 in 2022. Version 81x Regulatory Updates.

What Is Sui State Unemployment Insurance Tax Ask Gusto

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

The True Cost Of Hiring An Employee In California Hiring True Cost California

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Futa Federal Unemployment Tax Act San Francisco California