bexar county tax assessor property search

King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the. Editors frequently monitor and verify these resources on a routine basis.

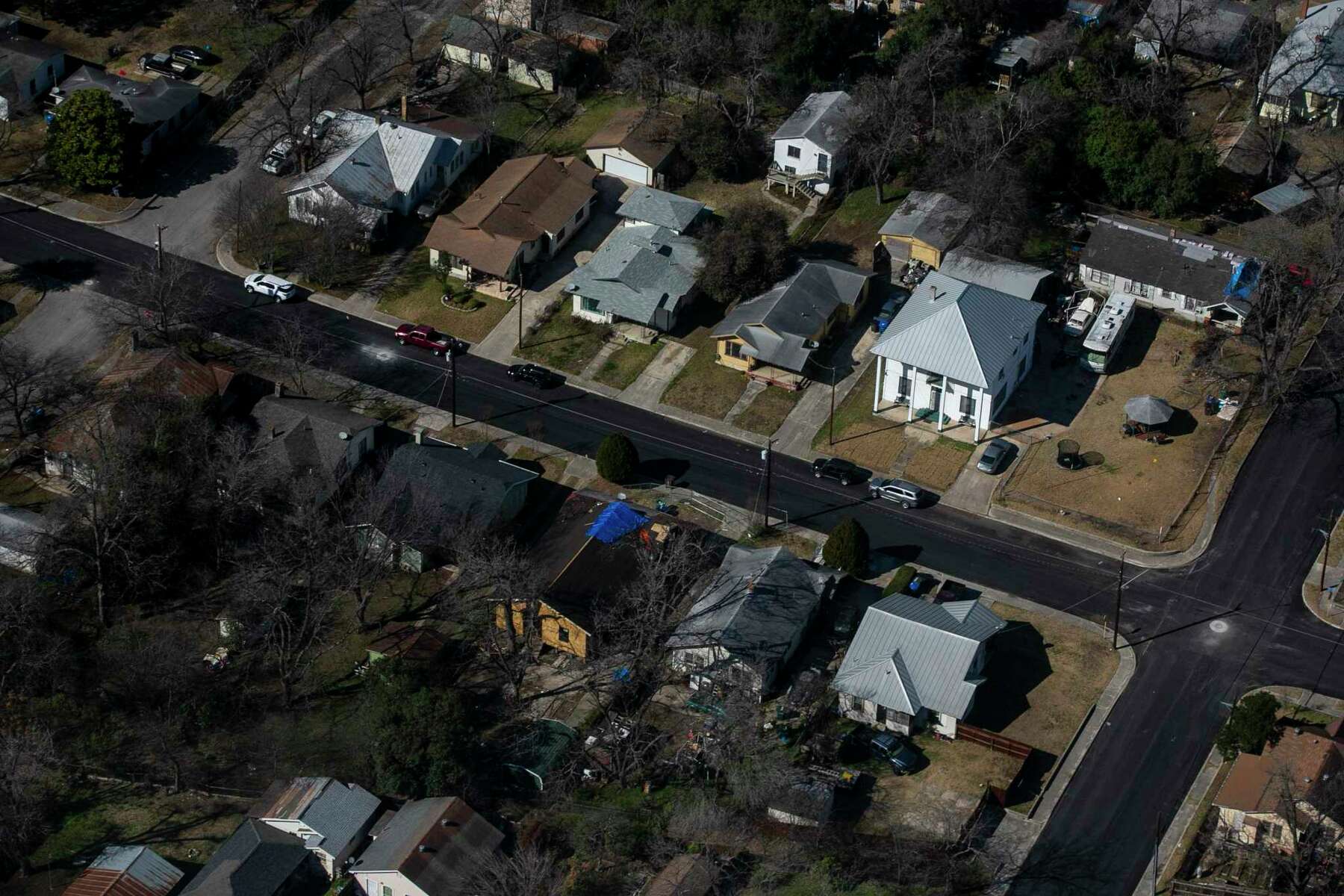

Sticker Shock Bexar County Home Appraisals Up Nearly 28

Search for an account whose property taxes are collected by Bexar County.

. The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. NETR Online Henderson Henderson Public Records Search Henderson Records Henderson Property Tax Texas Property Search Texas Assessor.

The Medina County Property Records Search Texas links below open in a new window and take you to third party websites that provide access to Medina County public records. Search Bexar County property tax and assessment records by owner name property address and account number. The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. After locating the account you can pay online by credit card or eCheck. Bexar County Property Records Search Links.

Where to get. Disabled person exemption Age 65 or Over exemption Disabled Veteran exemption or. Bexar County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Bexar County Texas.

The Bexar County Arrest Records Search Texas links below open in a new window and take you to third party websites that provide access to Bexar County public records. Public Sale of Property PDF. Learn about Death Records including.

Death Records are kept by Vital Records Offices or Bexar County Clerks Offices which may be run by the state or at the local level. 100 Dolorosa San Antonio TX 78205 Phone. Benton County collects the highest property tax in Arkansas levying an average of 92900 06 of median home value yearly in property taxes while Calhoun County has the lowest property tax in the state collecting an average tax of 27500 053 of.

GIS stands for Geographic Information System the field of data management that charts spatial locations. For more information on property values call BCAD at 210-242-2432. Property taxes in America are collected by local governments and are usually based on the value of a property.

Gonzales PCC Public Information Manager. Editors frequently monitor and verify these resources on a routine basis. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of.

Property Tax Payment Options. Pay Taxes OnlineBy Phone. The exact property tax levied depends on the county in Texas the property is located in.

Medina County Property Records Search Links. Director Property Tax Department. Help others by sharing new links and reporting broken links.

These warrants may be issued by local or Bexar County law enforcement agencies and they are signed by a judge. You may find it listed under real estate data real estate records or property records If the tax records arent available you may need to search property records. Assessor Collector and Delinquent Taxes.

Editors frequently monitor and verify these resources on a routine basis. This applies only in the case of residential homestead and cannot exceed the lesser of the market value or the preceding years appraised value plus 10 plus the value of any improvements added since the last re-appraisal. Property Tax Late Charges.

Members can search Bexar County TX certified property tax appraisal roll data by Owner Name Street Address or Property ID. Once you have that you can visit the tax assessors website for that county to see if they have the tax information for the deed listed online. Search accounts whose taxes are collected by Bexar County for overpayments.

Bexar County Tax Assessor-Collector Albert Uresti says hes accepting applications until July 25 that will apply to 2022 property tax bills even though the deadline was technically in April. Bexar County Tax Assessor-Collector Office P. Homeowners in Bexar County who are over 65 years old may be able to claim for a senior citizens property tax exemption giving them a reduction of between 5000 and 65000 off their assessed property value depending on their exact location within the County.

The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg flood control districts sanitation districts. TaxNetUSA members with a Bexar County TX Pro subscription can search both certified and preliminary appraisal data by Year Built Square Footage Deed Date Value Range Property Type and many more advanced search. A Bexar County Warrant Search provides detailed information on whether an individual has any outstanding warrants for his or her arrest in Bexar County Texas.

There are several options available to taxpayers including Half Pay and Pre-Payment Plans. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. How to participate in a Public Sale of Property by Bexar County.

I cant tell you how that just breaks my heart said Uresti. After locating the account you can pay online by credit card or eCheck. We still have a lot of families that dont have the residential exemption.

Box 839950 San Antonio TX 78283-3950. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead with one of the following exemptions. The money collected is generally used to support community safety schools infrastructure and other public projects.

The Bexar County Property Records Search Texas links below open in a new window and take you to third party websites that provide access to Bexar County public records. 100 Dolorosa San Antonio TX 78205 Phone. Overview of Property Taxes.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. Property Tax Payment Plans PDF e-Statement Instructions.

How to search online for Death Records. Bexar County Tax Assessor and Collector Vista Verde Plaza Building 233 North Pecos La Trinidad San Antonio TX 78207 Phone 210335-2251. The exact property tax levied depends on the county in Arkansas the property is located in.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. For details contact the Bexar County Tax Assessor-Collectors Office. Help others by sharing new links and reporting broken.

These can include Bexar County death certificates local and Texas State death registries and the National Death Index. The second step is determining the propertys assessed value which is obtained by subtracting the homestead cap loss value from the appraised value. Property taxes are collected by the county although they are governed by California State LawThe Tax Collector of Riverside County collects taxes on behalf of the following entities.

Bexar County Commissioners Approve 20 Homestead Exemption

Want Lower Property Taxes A Step By Step Guide For Protesting Your Appraisal San Antonio Heron

Property Tax Appeal Tips To Reduce Your Property Tax Bill

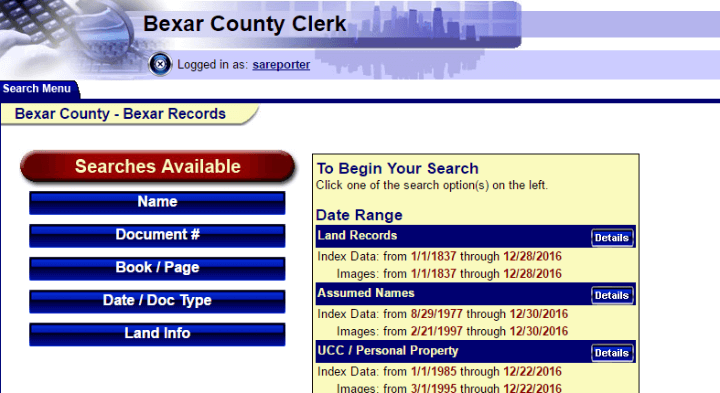

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

The Bexar County Property Appraisal Protest Deadline Was 5 P M Monday

Kevin Spacey Kevin Spacey Kevin Frank Underwood

Property Tax Information Bexar County Tx Official Website

Bexar County Property Tax Deadline Looming Tpr

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Property Tax Information Bexar County Tx Official Website

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Bexar County Once Again Selling Homes Delinquent On Their Taxes

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

Bexar County Property Appraisals Released And They Re Through The Roof

.jpg)

Deadline Arrives For Property Appraisal Protests In Bexar County Tpr

Bexar County Residents Behind On Mortgages Property Taxes Encouraged To Apply For Assistance Gr Youtube